What are recurring expenses?

Recurring expenses occur on a fixed cadence, and can be for a fixed or varying amount. Often, they’re monthly expenses, but can also be weekly, yearly, etc.

We automatically track recurring expenses and let you know when to expect them every month. Easily calculate and organize recurring expenses as part of your monthly budget — and avoid overpaying for unused services!

What are recurring items?

Recurring items include recurring expenses, and recurring income.

Why is it important to track recurring expenses & items?

Recurring expenses can easily add up. It’s important to keep track of bills and payments, so budgeting can be done properly.

Lunch Money can:

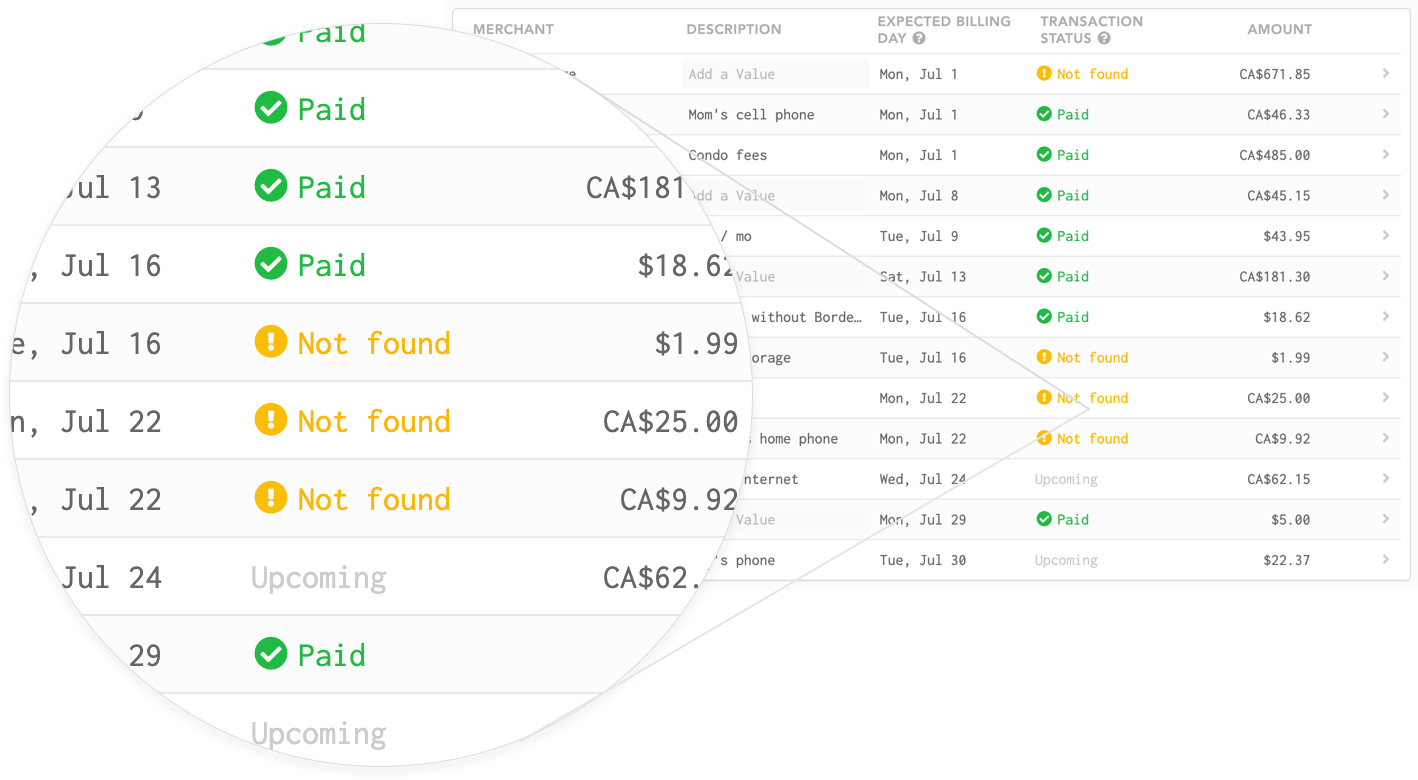

Easily detect discrepancies — track when or if a recurring item has been charged.

Calculate your minimum living cost — figure out how much money you would need to pay for essentials (rent, groceries, utilities).

Separate your recurring items from daily expenditures — exclude expenses like rent from your analysis.

Keep track of recurring income — get the full picture of your personal finances.

How does Lunch Money help?

We automatically detect recurring expenses and let you know when to expect them every month. Easily calculate, organize, and anticipate your recurring expenses to avoid overpaying for unused services!

Rules Engine

Our Rules Engine is great at automatically detecting recurring items. For example, a rule can recognize transactions that match a hydro expense and are between $20 and $25 dollars, and link them to recurring expenses.

In a lot of other systems, I've found it too tiring to make it functional, and just gave up. But I actually got all of this year's expenses set in a couple hours.